The stock market continues to be a powerful tool for wealth creation, offering individuals an opportunity to achieve long-term financial stability. In 2025, investing has become more accessible thanks to cutting-edge technology, AI-powered analytics, and commission-free trading platforms. However, beginners often hesitate due to risks and lack of knowledge. Link Earn Hub is here to change that! Our expert guide How to Start Investing in Stocks in 2025, provides the essential steps, strategies, and insights you need to confidently enter the world of stock investing.

1. Introduction

What is Stock Investing?

Stock investing involves buying shares of publicly traded companies. When you purchase a stock, you own a small portion of that company, giving you the potential to earn from price appreciation and dividends. The stock market can provide better returns than traditional savings accounts, making it an attractive option for wealth-building.

Why Should You Invest in Stocks?

Investing in stocks offers several advantages. Over time, stocks have consistently outperformed other investment options like fixed deposits and bonds. They also help combat inflation, ensuring your money grows instead of losing value. Another key benefit is passive income through dividend-paying stocks, which provide steady earnings without additional effort.

Common Misconceptions About Stock Investing

Many people believe that investing in stocks requires a large sum of money or deep financial knowledge. This is not true. Thanks to modern platforms, you can start investing with as little as $1. Another myth is that the stock market is only for professionals, but with Link Earn Hub’s expert tips, even beginners can make smart investment decisions.

2. Understanding the Stock Market

What is the Stock Market?

The stock market is a platform where investors buy and sell company shares. It operates through exchanges such as the New York Stock Exchange (NYSE) and Nasdaq. Companies list their stocks on these exchanges to raise capital, allowing investors to own a piece of their business.

How Stocks Work

When you invest in a stock, you become a shareholder of that company. If the company performs well, the stock price increases, allowing you to sell it at a profit. Some companies also distribute dividends, which are regular payouts to shareholders. However, stock prices fluctuate based on supply, demand, and market trends, which is why research is crucial.

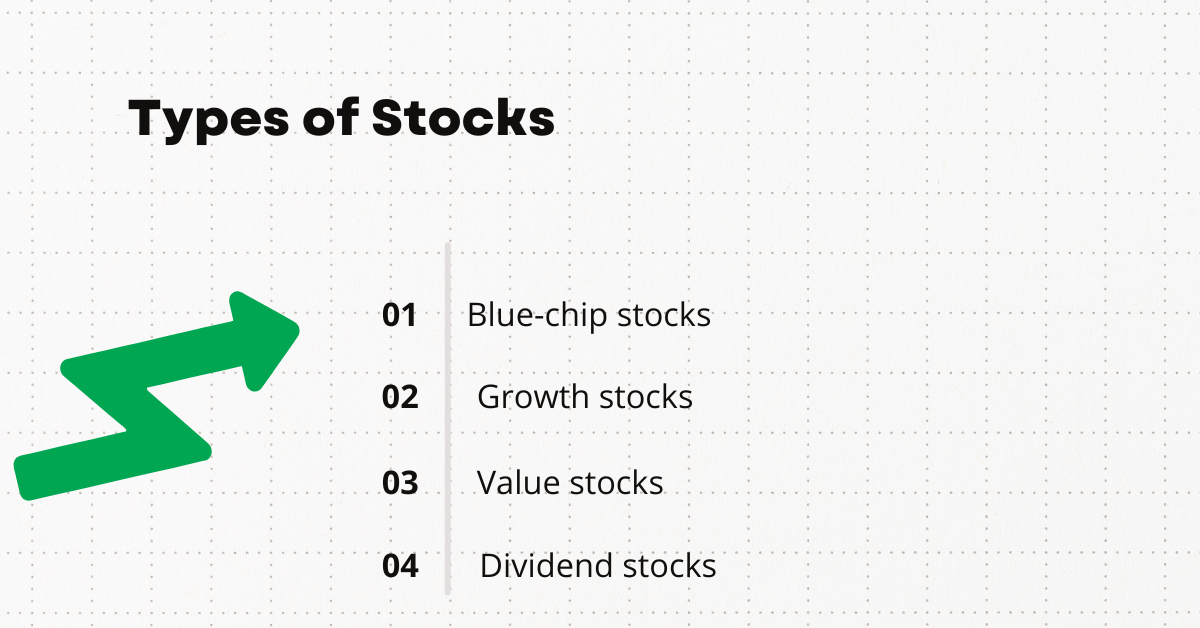

Types of Stocks

Types of Stocks

- Blue-chip stocks – Large, well-established companies with stable earnings (e.g., Apple, Microsoft).

- Growth stocks – Companies expected to grow faster than the market average.

- Value stocks – Stocks that are undervalued but have strong long-term potential.

- Dividend stocks – Stocks that pay regular dividends, ideal for passive income.

3. Preparing to Invest

Assessing Your Financial Goals & Risk Tolerance

Before you start investing, determine your goals. Are you investing for retirement, short-term gains, or passive income? Understanding your risk tolerance is also important. If you’re risk-averse, safer options like ETFs or dividend stocks might be best. If you’re comfortable with higher risk, growth stocks or tech stocks may provide better returns.

Setting a Budget

It’s essential to invest only what you can afford to lose. A smart approach is the 50-30-20 rule, where you allocate:

- 50% of your income to necessities,

- 30% to personal expenses, and

- 20% to savings and investments.

By following this rule, you ensure financial security while steadily growing your investments.

Understanding Investment Strategies

There are different strategies for stock investing. Long-term investing involves holding stocks for years, benefiting from compound growth. Short-term trading, on the other hand, involves frequent buying and selling to capitalize on price fluctuations. Beginners should focus on long-term investing to reduce risk.

4. Choosing a Brokerage Account

What is a Brokerage Account?

A brokerage account allows you to buy and sell stocks through online platforms. It acts as an intermediary between you and the stock market. Choosing the right broker is crucial for a seamless investing experience.

How to Choose the Right Brokerage?

- Low fees & commissions – Look for commission-free platforms like Robinhood and Link Earn Hub.

- User-friendly interface – Ensure the platform is easy to navigate.

- Research tools & analytics – Choose brokers that provide educational resources and market analysis.

Online vs. Traditional Brokerages

Online brokerages are ideal for beginners as they offer low-cost trading, educational resources, and mobile trading apps. Traditional brokerages provide personalized services but often charge higher fees. Link Earn Hub recommends online brokerages for cost-effective investing.

5. Researching Stocks & Market Trends

Fundamental Analysis (FA)

Fundamental analysis helps investors evaluate a company’s financial health by looking at earnings reports, revenue growth, debt levels, and competitive advantages. Key metrics include:

- Earnings Per Share (EPS) – Indicates a company’s profitability.

- Price-to-Earnings Ratio (P/E Ratio) – Compares stock price to earnings to assess value.

- Dividend Yield – Shows how much a company pays in dividends relative to its stock price.

Fundamental Analysis

Technical Analysis (TA)

Technical analysis involves studying stock price charts and trends to predict future movements. Common indicators include:

- Moving Averages – Identifies trends by averaging past stock prices.

- Relative Strength Index (RSI) – Measures momentum and overbought/oversold conditions.

Technical Analysis

By combining both types of analysis, investors can make well-informed decisions.

6. Building a Diversified Portfolio

Why is Diversification Important?

Diversification reduces risk by spreading investments across different sectors. Instead of putting all your money in a single stock, invest in multiple industries like technology, healthcare, and finance.

How to Diversify Your Investments

- Mix stocks, ETFs, and mutual funds for balanced growth.

- Include both high-growth and stable stocks in your portfolio.

- Rebalance your portfolio periodically to maintain optimal asset allocation.

7. Investing Strategies for Beginners

Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount regularly, regardless of market conditions. This strategy minimizes risk and helps average out stock price fluctuations over time.

Value Investing

This strategy, promoted by Warren Buffett, involves buying undervalued stocks and holding them long-term. It’s a great approach for patient investors.

Dividend Investing

Dividend investing focuses on stocks that pay regular dividends. This strategy provides a steady income stream and is suitable for conservative investors.

8. Risk Management & Avoiding Common Mistakes

Managing Market Volatility

Stock markets can be unpredictable, but long-term investing helps reduce the impact of short-term volatility. Avoid panic-selling during downturns and focus on fundamentals.

Common Mistakes to Avoid

- Investing without research

- Following market hype blindly

- Not having an exit strategy

- Over-investing in one stock

9. The Future of Investing: Trends in 2025

The stock market in 2025 is expected to be driven by AI, algorithmic trading, and ESG investing (sustainable stocks). More investors are focusing on companies that prioritize environmental, social, and governance (ESG) factors. Robo-advisors and AI-powered trading platforms are also making investment decisions easier for beginners.

10. Conclusion about How to Start Investing in Stocks in 2025

Investing in stocks is one of the best ways to build financial security. By starting with a clear plan, choosing the right broker, and following proven strategies, you can achieve long-term success. Link Earn Hub is here to guide you every step of the way, helping you make smart investment decisions.

2. Is stock investing risky?

Yes, but risk can be minimized through research, diversification, and long-term investing.

3. What are the best stocks for beginners?

Blue-chip stocks and index funds like the S&P 500 are good choices.

4. How do I stay updated on market trends?

Follow financial news, use stock market apps, and visit Link Earn Hub for expert insights.

Leave A Comment